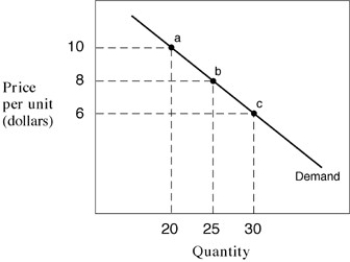

Exhibit 5-1 Demand curves

-In Exhibit 5-1,between points a and b,the price elasticity of demand measures:

Definitions:

Corporate Tax Rate

The tax imposed on the net income of a corporation.

Capital Structure

The mix of a company's long-term debt, specific short-term debt, common equity and preferred equity, determining its financial stability and strategy.

WACC

Weighted Average Cost of Capital; an analysis of a company's capital expenditure costs, weighted proportionally across different capital categories.

Cost of Debt

The cost of debt is the effective rate that a company pays on its borrowed funds, accounting for interest expenses on all debts.

Q18: An entrepreneur is a motivated person who

Q20: Tax incidence means that:<br>A)government increases tax.<br>B)the tax

Q28: Perfectly competitive markets are characterised by:<br>A)a large

Q35: By filling in the blanks in Exhibit

Q64: Which of the following words indicate the

Q69: As shown in Exhibit 6-6,the average fixed

Q71: The law of increasing costs indicates that

Q75: The production possibility curve is bowed outward

Q84: Which of the following is not an

Q115: If the price elasticity of demand is