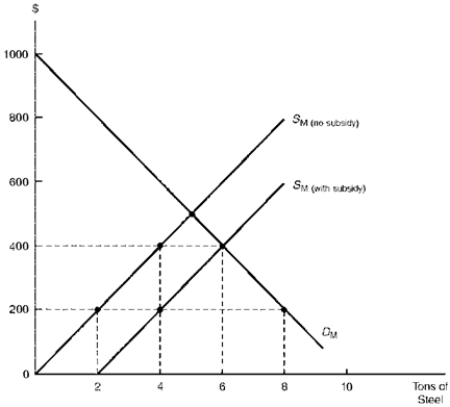

Figure 5.1 illustrates the steel market for Mexico, assumed to be a "small" country that is unable to affect the world price. Suppose the world price of steel is given and constant at $200 per ton. Now suppose the Mexican steel industry is able to obtain trade protection.

Figure 5.1. Alternative Nontariff Trade Barriers Levied by a "Small" Country

-Consider Figure 5.1.Suppose the rest of the world voluntarily agrees to reduce steel shipments to Mexico vis-a-vis an export quota equal to 2 tons.Assuming Mexican importers behave as monopoly buyers while foreign exporters behave as competitive sellers, the overall welfare loss of the quota to Mexico is

Definitions:

Q17: A specification of a maximum amount of

Q27: Free traders maintain that an open

Q39: The Ricardian theory of comparative advantage assumes

Q50: Developing countries have often felt that it

Q65: "The equilibrium relative commodity price at which

Q67: In a two-country, two-product world, the statement

Q92: Consider Figure 5.5. The deadweight welfare loss

Q106: Consider Figure 6.2. With free trade, Mexican

Q107: In the short run, Mexico would realize

Q149: Is it possible to estimate the gains