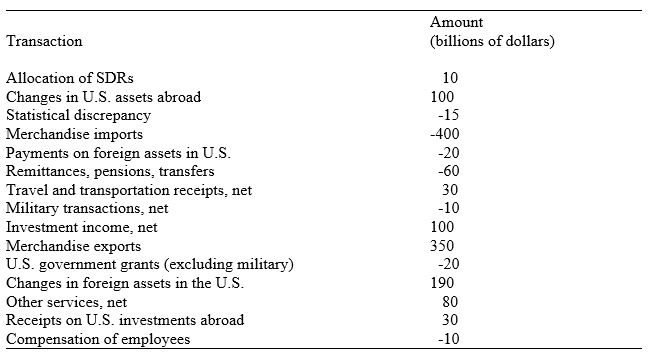

Table 10.3 shows hypothetical transactions,in billions of U.S.dollars,that took place during a year.

Table 10.3.International Transactions of the United States

-Refer to Table 10.3.The payments data suggest that the United States was a "net demander" of $30 billion from the rest of the world.

Definitions:

Cost Method

An accounting approach for investments, outlining that an investment is recorded at its acquisition cost, adjusting for any dividends received.

Deferred Tax Asset

An accounting term representing an asset that may be used to reduce any future tax liability originating from temporary timing differences between the accounting and tax treatment of transactions.

Deferred Tax Liability

Future tax obligations due to temporary differences between the accounting and tax treatment of transactions.

Tax Basis

The value of a taxpayer's investment in property for tax purposes, used to calculate gain or loss on a sale or transfer.

Q10: Which example of market expectations causes

Q10: Which industrialization policy used by developing countries

Q13: Suppose that an American automobile manufacturer establishes

Q19: With arbitrage, a trader attempts to purchase

Q26: By establishing transplant factories in the United

Q28: Consider Figure 6.3. In response to Iraq's

Q66: By increasing relative U.S. production costs, a

Q89: The gold standard's "rules of the game"

Q101: Suppose that Mexico and Canada form a

Q113: Grain shortages in countries that buy large