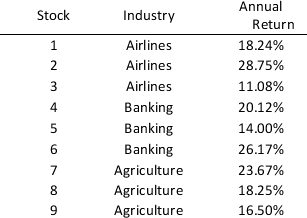

Andrew is ready to invest $200,000 in stocks and he has been provided nine different alternatives by his financial consultant. The following stocks belong to three different industrial sectors and each sector has three varieties of stocks each with different expected rate of return. The average rate of return taken for the past ten years is provided with each of the nine stocks.

The decision will be based on the constraints provided below:

-Exactly 5 alternatives should be chosen.

-One stock can have a maximum invest of $55,000.

-Any stock chosen must have a minimum investment of at least $25,000.

-For the Airlines sector, the maximum number of stocks chosen should be two.

-The total amount invested in Banking must be at least as much as the amount invested in Agriculture.

Now, formulate a model that will decide Andrew's investment strategy to maximize his expected annual return.

Definitions:

Production Departments

Specific areas or units within a manufacturing facility responsible for different stages of the production process.

Support Department Costs

Expenses associated with departments that provide internal support or services to other departments within a company rather than directly contributing to profit generation.

Production Departments

Divisions within a manufacturing company responsible for different stages of production processes, focusing on specific tasks or products.

Plantwide Factory Overhead Rate

Plantwide Factory Overhead Rate is the single overhead rate calculated by dividing total factory overhead by the total base (such as direct labor hours or machine hours) used to allocate overhead costs to products.

Q9: The Roman numeral XLII should be interpreted

Q12: If there are 85 mg of medicine

Q13: Which of the following groups of drugs

Q22: The conceptual model:<br>A) helps in organizing the

Q26: The nurse is teaching a patient about

Q31: The imposition of integer restriction is necessary

Q38: The objective function for an optimization problem

Q51: The _ is a point estimate of

Q53: The moving averages method refers to a

Q58: In designing an effective table,<br>A) avoid the