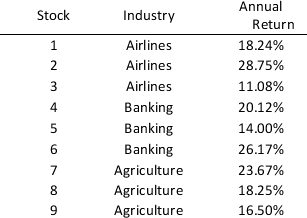

Andrew is ready to invest $200,000 in stocks and he has been provided nine different alternatives by his financial consultant. The following stocks belong to three different industrial sectors and each sector has three varieties of stocks each with different expected rate of return. The average rate of return taken for the past ten years is provided with each of the nine stocks.

The decision will be based on the constraints provided below:

-Exactly 5 alternatives should be chosen.

-One stock can have a maximum invest of $55,000.

-Any stock chosen must have a minimum investment of at least $25,000.

-For the Airlines sector, the maximum number of stocks chosen should be two.

-The total amount invested in Banking must be at least as much as the amount invested in Agriculture.

Now, formulate a model that will decide Andrew's investment strategy to maximize his expected annual return.

Definitions:

Frail Elderly

Older adults who are in a diminished physical condition and have increased risk for adverse health outcomes, such as falls, hospitalizations, and dependency.

Daughters-in-Law

Women who are married to one's son and are thus integrated into the family.

Public Agencies

Government organizations that provide services to the public, manage resources, and enforce laws and regulations.

Sarcopenia

The loss of muscle mass and strength that occurs with aging.

Q11: The LPN/LVN is a member of the

Q16: Compute the mode for the following data:

Q18: Reference - 9.1. The part-worths for each

Q20: Which of the following health care professionals

Q24: Greenbell Software Inc. conducted a study on

Q25: Special hand hygiene techniques and care of

Q27: A(n) _ refers to a model input

Q37: Reference - 10.2. What is the minimum

Q51: Separate error rates with respect to the

Q56: Which of the following gives the proportion