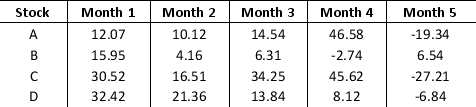

Consider the stock return data given below.

Develop and solve the Markowitz model that maximizes expected return subject to a maximum variance of 35. Use this model to construct an efficient frontier by varying the maximum allowable variance from 25 to 55 in increments of 5 and solving for the maximum return for each.

Definitions:

Macaulay Duration

A measure of the weighted average time until a bond or fixed income portfolio's cash flows are received, used to gauge interest rate sensitivity.

Yield

The income returned on an investment, such as the interest or dividends received, typically expressed as a percentage of the investment’s cost or current market value.

Modified Duration

Modified Duration measures the sensitivity of the price of a bond or other debt instrument to a change in interest rates, indicating the percentage change in price for a parallel shift in rates.

Modified Duration

A measure of the sensitivity of a bond's or bond portfolio's price to changes in interest rates, adjusting for the changing yield to maturity.

Q1: To generate scatter chart matrix, we use<br>A)

Q7: Which of the following is a common

Q8: A _ classifies a categorical outcome variable

Q8: Reference - 10.1. Which of the following

Q9: A medication should be withheld when which

Q15: A nurse discovers that an infusion is

Q16: Lithium is an antimanic drug that is

Q39: _ is a measure of calculating dissimilarity

Q53: Ethan Steel, Inc. has two factories that

Q58: A soft drink manufacturing company has 3