The Golden Jill Mining Company is interested in procuring 10,000 acres of coal mines in Powder River Basin. The mining company is considering two payment-plan options to buy the mines:

I. 100% Payment

II. Installment-Payment

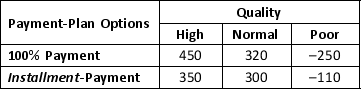

The payoff received will be based on the quality of coal obtained from the mines which has been categorized as High, Normal, and Poor Quality as well as the payment plan. The profit payoff in million dollars resulting from the various combinations of options and quality are provided below:

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

b. If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches?

Definitions:

Capital Intensive

Refers to businesses or industries that require large amounts of money and resources to produce goods or services.

Service-Related

Pertaining to activities or businesses that focus on providing services, rather than producing goods, to customers or clients.

Productivity

A measure of the efficiency of a person, machine, factory, system, etc., in converting inputs into useful outputs.

Forward Scheduling

A planning method that begins scheduling from a known start date and then adds tasks sequentially to determine project completion date.

Q3: Hormones may be prescribed for a patient

Q3: Choosing a decision alternative that maximizes the

Q5: Which of the following statements,if made by

Q9: In a nonlinear optimization problem:<br>A) the objective

Q13: Nurses working with older adult patients must

Q14: The nurse should document drug administration at

Q16: Factors that may contribute to patient medication

Q19: Which of the following drugs should be

Q21: A patient is taking 36 units of

Q44: _ refer to the probabilities of the