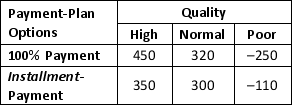

The Golden Jill Mining Company is interested in procuring 10,000 acres of coal mines in Powder River Basin. The mining company is considering two payment-plan options to buy the mines:

I. 100% Payment

II. Installment-Payment

The payoff received will be based on the quality of coal obtained from the mines which has been categorized as High, Normal, and Poor Quality as well as the payment plan. The profit payoff in million dollars resulting from the various combinations of options and quality are provided below:

a. Suppose that management believes that the probability of obtaining High Quality coal is 0.55, probability of Normal Quality Coal is 0.35, and probability of Poor Quality Coal is 0.1. Use the expected value approach to determine an optimal decision.

a. Suppose that management believes that the probability of obtaining High Quality coal is 0.55, probability of Normal Quality Coal is 0.35, and probability of Poor Quality Coal is 0.1. Use the expected value approach to determine an optimal decision.

b. Suppose that management believes that the probability of High Quality coal is 0.25, probability of Normal Quality Coal is 0.4, and probability of Poor Quality Coal is 0.35. What is the optimal decision using the expected value approach?

Definitions:

Q3: Choosing a decision alternative that maximizes the

Q5: In a linear programming model, the _

Q10: The nurse prepares to administer an IV

Q13: A patient has been on antibiotic therapy

Q14: A patient is seen regularly for hypertension.When

Q15: Diphenhydramine (Benadryl)is an antiemetic;it is also used

Q17: A research team in at the Gonzaga

Q18: Reference - 9.1. The part-worths for each

Q31: Roger is willing to promote and sell

Q53: Reference - 11.1: Which of the following