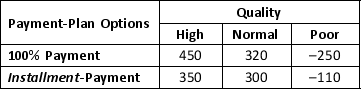

The Golden Jill Mining Company is interested in procuring 10,000 acres of coal mines in Powder River Basin. The mining company is considering two payment-plan options to buy the mines:

I. 100% Payment

II. Installment-Payment

The payoff received will be based on the quality of coal obtained from the mines which has been categorized as High, Normal, and Poor Quality as well as the payment plan. The profit payoff in million dollars resulting from the various combinations of options and quality are provided below:

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

a. What is the decision to be made, what is the chance event, and what is the consequence for this problem? How many decision alternatives are there? How many outcomes are there for the chance event?

b. If nothing is known about the probabilities of the chance outcomes, what is the recommended decision using the optimistic, conservative, and minimax regret approaches?

Definitions:

Indirect Expenses

Expenses that are not directly linked to specific product production or service provision, such as utilities and rent.

Fixed Expenses

Expenses that do not change with the level of production or business activity, such as rent, salaries, and insurance premiums.

Departmental Cost Analysis

The process of evaluating and breaking down the costs associated with each department within an organization, facilitating budgeting and efficiency improvements.

Direct Costs

Direct costs are expenses that can be directly traced to the production of a specific good or service, without any allocation.

Q4: The LPN is teaching a patient about

Q7: A type 2 diabetic patient is learning

Q13: Which of the following groups of drugs

Q14: The average cost/unit for the production of

Q19: If an IV has become infiltrated,the nurse

Q22: In a fixed-cost model, each fixed cost

Q24: In a(n) _ relationship between two quantities,

Q37: A manufacturing company introduces two product alternatives.

Q55: A tree diagram used to illustrate the

Q56: Which of the following approaches to solving