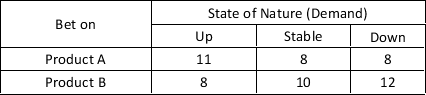

A Manufacturing company introduces two product alternatives. The table below provides profit payoffs in thousands of dollars.

The probabilities for the state of nature are P(Up) = 0.35, P(Stable) = 0.35, and P(Down) = 0.30.

A test market study of the potential demand for the product is expected to report either a favorable (F) or unfavorable (U) condition. The relevant conditional probabilities are as follows:

P(F|Up) = 0.5; P(F|Stable) = 0.3; P(F|Down) = 0.2

P(U|Up) = 0.2; P(U|Stable) = 0.3; P(U|Down) = 0.5

Use Bayes' theorem to compute the conditional probability of the demand being up, stable, or down, given each market research outcome.

Definitions:

Current Liabilities

Short-term financial obligations that a company owes and are due within one year.

Total Liabilities

The sum of all financial obligations or debts that a company owes to outside parties.

Acid-Test Ratio

A financial metric used to determine a company’s ability to pay off its short-term liabilities with its most liquid assets, excluding inventory.

Marketable Securities

Financial instruments that can be quickly converted into cash at a reasonable price.

Q4: Effects of calcium on the body include

Q6: Which of the following states the objective

Q12: An HIV-infected patient asks,"Why do you have

Q13: The nurse is teaching a patient about

Q13: A patient taking antiinflammatory drugs tells the

Q15: New information obtained through research or experimentation

Q25: Observation refers to the:<br>A) estimated continuous outcome

Q28: A patient arrives at the emergency department

Q36: Reference - 8.1. Restrictions on the type

Q57: Which of the following would be a