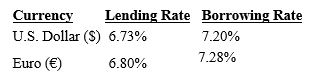

Assume the following information regarding U.S. and European annualized interest rates:

Trensor Bank can borrow either $20 million or €20 million. The current spot rate of the euro is $1.13. Furthermore, Trensor Bank expects the spot rate of the euro to be $1.10 in 90 days. What is Trensor Bank's dollar profit from speculating if the spot rate of the euro is indeed $1.10 in 90 days?

Definitions:

Bacon and Eggs

A popular breakfast dish in various cultures consisting of fried bacon and eggs.

Cross-Price Elasticity

A measure used in economics to show how the quantity demanded of one good changes in response to a change in the price of another good.

Inferior Goods

Goods for which demand decreases as the income of the consumer increases, opposite to normal goods.

Normal Goods

Goods for which demand increases as consumers' income increases, holding all other factors constant.

Q19: Whirlpool took a 53% stake in the

Q25: A Japanese yen is worth $.0080, and

Q55: A currency put option provides the right,

Q66: As foreign exchange activity has grown, a

Q67: A small firm has decided to enter

Q69: Assume the bid rate of an Australian

Q83: A U.S. corporation has purchased currency call

Q97: Futures contracts are typically _; forward contracts

Q130: Cause-related marketing is part of _.<br>A) action

Q143: The purpose of strategic control is to