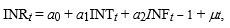

The following regression model was estimated to forecast the value of the Indian rupee (INR) :

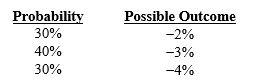

Where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the United States and India, and INF is the inflation rate differential between the United States and India in the previous period. Regression results indicate coefficients of a₀ = .003; a₁ = -.5; and a₂ = .8. Assume that INFt - 1 = 2 percent. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:

The expected change in the Indian rupee in period t is:

Definitions:

Present Condition

The current state or situation of an object, individual, or scenario, often assessed to make decisions or predictions.

Financial Advantage

Refers to the benefit gained in financial terms, which could stem from various sources such as economies of scale, portfolio diversification, or market position.

Production

The process of creating goods or services using labor, materials, and machinery.

Annual Sales

The total volume of revenue generated from goods or services sold by a company in a fiscal year.

Q6: Assume that Japan places a strict quota

Q8: If it was determined that the movement

Q14: A money market hedge involves taking a

Q24: Procedural and documentation requirements imposed by the

Q29: Any event that reduces the supply of

Q40: The one-year forward rate of the British

Q59: Sensitivity analysis allows for all of the

Q62: Under a fixed exchange rate system, U.S.

Q63: When measuring forecast performance of different currencies,

Q64: In a forward hedge, if the forward