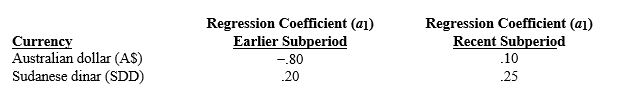

The following regression model was run by a U.S.-based MNC to determine its degree of economic exposure as it relates to the Australian dollar and Sudanese dinar (SDD) : where the term on the leFt-hand side is the percentage change in inflation-adjusted cash flows measured in the firm's home currency over period t, and et is the percentage change in the exchange rate of the currency over period t. The regression was run over two subperiods for each of the two currencies, with the following results:

where the term on the leFt-hand side is the percentage change in inflation-adjusted cash flows measured in the firm's home currency over period t, and et is the percentage change in the exchange rate of the currency over period t. The regression was run over two subperiods for each of the two currencies, with the following results:

Based on these results, which of the following statements is probably not true?

Definitions:

Materials Quantity Variance

The variance between the real amount of materials utilized in manufacturing and the anticipated standard amount, times the standard unit cost.

Overhead Variance

The difference between the actual overhead costs incurred and the standard or expected overhead costs.

Direct Materials Price Variance

Direct materials price variance is the difference between the actual cost of direct materials and the standard cost, showing how much more or less was spent on purchasing materials.

Direct Labor Quantity Variance

The difference between the actual hours worked and the standard hours allowed, multiplied by the standard rate, indicating efficiency in labor usage.

Q18: An advantage of a short straddle is

Q32: Fixed costs are expenses that are not

Q37: Johnson Co. has 1,000,000 euros as payables

Q41: Because before-tax cash flows are necessary for

Q44: Assume that Patton Co. will receive 100,000

Q57: Since country risk is constantly changing and

Q58: If a foreign currency is expected to

Q69: The sale of a subsidiary by an

Q80: A put option on Swiss franc has

Q152: American-style options can be exercised any time