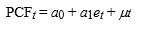

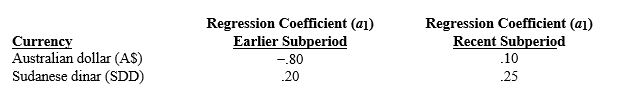

The following regression model was run by a U.S.-based MNC to determine its degree of economic exposure as it relates to the Australian dollar and Sudanese dinar (SDD) : where the term on the leFt-hand side is the percentage change in inflation-adjusted cash flows measured in the firm's home currency over period t, and et is the percentage change in the exchange rate of the currency over period t. The regression was run over two subperiods for each of the two currencies, with the following results:

where the term on the leFt-hand side is the percentage change in inflation-adjusted cash flows measured in the firm's home currency over period t, and et is the percentage change in the exchange rate of the currency over period t. The regression was run over two subperiods for each of the two currencies, with the following results:

Based on these results, which of the following statements is probably not true?

Definitions:

Q8: Which of the following is not a

Q8: According to the text, in order to

Q23: If a U.S. firm's cost of goods

Q24: Procedural and documentation requirements imposed by the

Q40: Which of the following theories suggests that

Q43: As opposed to transaction exposure, managing economic

Q51: The VaR method presumes that the distribution

Q53: A limitation of hedging translation exposure is

Q59: Assume a subsidiary is forced to borrow

Q75: A speculator in futures contracts who expects