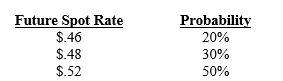

You are the treasurer of Arizona Corp. and must decide how to hedge (if at all) future receivables of 350,000 Australian dollars (A$) 180 days from now. Put options are available for a premium of $.02 per unit and an exercise price of $.50 per Australian dollar. The forecasted spot rate of the Australian dollar in 180 days is:

The 90-day forward rate of the Australian dollar is $.50.

What is the probability that the put option will be exercised (assuming Arizona purchased it) ?

Definitions:

Formal Research

A systematic investigation conducted to establish facts or principles or to collect information on a specific subject, typically following a predefined protocol.

Routine Tasks

Repetitive and regular activities performed as part of one's day-to-day professional responsibilities.

Bias Free

Communication or content that avoids unfair preferences or prejudices towards any particular group or individual.

Revising Phase

A stage in the writing or project development process where content is reviewed, and changes are made to improve clarity, effectiveness, or accuracy.

Q2: A _ currency may _ the volume

Q10: Which of the following is not a

Q11: Direct foreign investment is perceived by foreign

Q11: Economic exposure represents any impact of exchange

Q30: Since the results of both a money

Q39: Generally, MNCs with less foreign revenues than

Q39: Linden Co. has 1,000,000 euros as payables

Q42: Thornton Corp. is based in the U.S.

Q56: The translation gain (or loss) is simply

Q59: Which of the following is not a