Exhibit 14-1

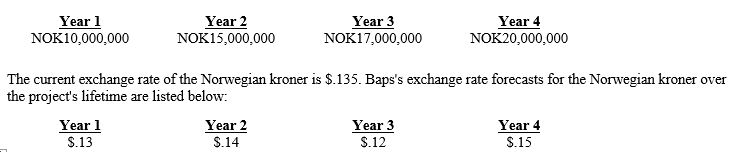

Assume that Baps Corp. is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5 million. If the project is undertaken, Baps would terminate the project aFter four years. Baps's cost of capital is 13 percent, and the project has the same risk as Baps's existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK) :

-Refer to Exhibit 14-1. Assume that NOK8,000,000 of the cash flow in Year 4 represents the salvage value. Baps is not completely certain that the salvage value will be this amount and wishes to determine the break-even salvage value, which is $____.

Definitions:

Full-Service

Describing businesses or offerings that provide a complete range of services or products, obviating the need for customers to seek supplemental providers.

Heritability

The extent to which genetic factors contribute to individual differences in a particular trait or behavior within a population.

Traits

Enduring characteristics or patterns of thoughts, feelings, and behaviors that are relatively stable over time and across situations, which differentiate one person from another.

Environment

The surrounding conditions, influences, or forces which affect the development, action, or survival of an individual or organism.

Q10: If a subsidiary project is assessed from

Q15: Premiums required to entice a target's board

Q21: If interest rate parity holds, then the

Q31: Sycamore (a U.S. firm) has no subsidiaries

Q33: The Multilateral Investment Guarantee Agency can provide

Q34: Which of the following is not a

Q35: Based on information in your text, all

Q36: When a country's currency is inconvertible, the

Q46: Insurance purchased to cover the risk of

Q57: If hedging projections cause a firm to