Exhibit 14-1

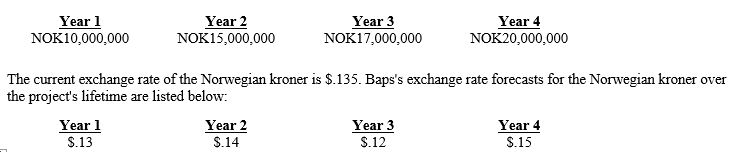

Assume that Baps Corp. is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5 million. If the project is undertaken, Baps would terminate the project aFter four years. Baps's cost of capital is 13 percent, and the project has the same risk as Baps's existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK) :

-Refer to Exhibit 14-1. What is the net present value of the Norwegian project?

Definitions:

Q2: The exposure of an MNC's consolidated financial

Q10: The absolute forecast error of a currency

Q18: Matis Corporation invests 1,500,000 South African rand

Q22: To fully benefit from use of foreign

Q43: Higher interest rates in a foreign country

Q47: Springfield Co., based in the United States,

Q48: A firm may incorporate a country risk

Q51: A database model is a general framework

Q67: Economic exposure refers to:<br>A)the exposure of a

Q74: Consider an MNC that is exposed to