Exhibit 14-1

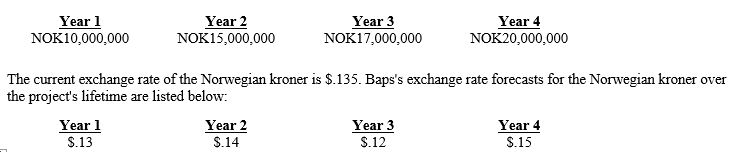

Assume that Baps Corp. is considering the establishment of a subsidiary in Norway. The initial investment required by the parent is $5 million. If the project is undertaken, Baps would terminate the project aFter four years. Baps's cost of capital is 13 percent, and the project has the same risk as Baps's existing projects. All cash flows generated from the project will be remitted to the parent at the end of each year. Listed below are the estimated cash flows the Norwegian subsidiary will generate over the project's lifetime in Norwegian kroner (NOK) :

-Refer to Exhibit 14-1. Baps is also uncertain regarding the cost of capital. Recently, Norway has experienced some political turmoil. What is the net present value (NPV) of this project if a 16 percent cost of capital is used instead of 13 percent?

Definitions:

Unconditional Positive Regard

A concept in client-centered therapy proposing that therapists should accept and support their clients regardless of what they say or do.

Humanist Therapists

Mental health professionals who focus on the individual's unique potential for personal growth and self-actualization.

Transference

In psychoanalysis, the process by which emotions and desires originally associated with one person are unconsciously transferred to another person.

Family-Systems Perspective

An approach to doing therapy with individuals or families by identifying how each family member forms part of a larger interacting system.

Q10: It can be more efficient to process

Q14: Which of the following is not true

Q19: An MNC has determined that the degree

Q25: Latin American countries have historically experienced relatively

Q34: Which of the following is not a

Q44: Consider an exporter that ships products to

Q67: Since the forward rate does not capture

Q69: A forward contract hedge is very similar

Q70: The VaR method assumes that the volatility

Q81: A put option essentially represents two swaps