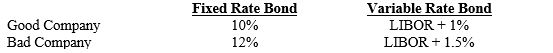

Good Company prefers variable to fixed rate debt. Bad Company prefers fixed to variable rate debt. Assume that Good and Bad Companies could issue bonds as follows:

Definitions:

Making a Decision

The cognitive process of selecting a course of action from among multiple alternatives, often involving weighing the risks and benefits of different options.

Utility Theory

A theory in economics that attempts to describe how individuals make choices based on the perceived satisfaction or utility from outcomes.

Framing of the Announcement

The way in which an announcement is presented or communicated, which can influence the perception and reaction of the audience.

Decision Making

The cognitive process of selecting a course of action from among multiple alternatives.

Q9: Managing economic exposure is generally perceived to

Q19: If shipment is made under a time

Q33: Currency swaps, whereby two parties exchange currencies

Q40: Assume the U.S. one-year interest rate is

Q41: The values from the application that pass

Q46: In conducting a multinational capital budgeting analysis,

Q52: Which of the following firms is not

Q55: A foreign subsidiary with expenses that are

Q64: Which of the following statements is correct?<br>A)

Q65: A(n) _ represents a work area or