Exhibit 21-1

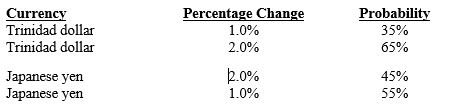

To benefit from the low correlation between the Trinidad dollar and the Japanese yen (¥) , Sciorra Corporation decides to invest 50 percent of total funds invested in Trinidad dollars and the remainder in yen. The domestic yield on a one-year deposit is 8 percent. The Trinidad one-year interest rate is 10 percent, and the Japanese one-year interest rate is 7 percent. Sciorra has determined the following possible percentage changes in the two individual currencies as follows:

-Refer to Exhibit 21-1 above. What is the probability that the yield of the two-currency portfolio is less than the domestic yield?

Definitions:

Q7: The cost of capital incurred by U.S.-based

Q9: The _ clause follows the SELECT clause

Q24: If modifications are made to the code

Q27: In general, an MNC that is _

Q29: The _ loop is constructed with conditions

Q34: If movements of two currencies with low

Q36: Assume the annual British interest rate is

Q40: Since the cost of funds can vary

Q52: If the _ clause of a SELECT

Q74: A(n)<u> procedure</u> is used to accomplish one