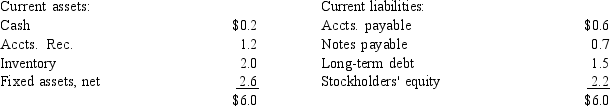

In 20X3, the Fillmore Company's sales were $12.0 million.Its balance sheet at year end 20X3 is shown below.Fillmore's 20X4 sales are expected to be $15 million and its 20X5 sales are expected to be $18 million.Earnings after tax in both years is expected to be 5.0% of sales, and annual dividends of $250,000 are expected to be paid in both 20X4 and 20X5.The company presently has excess plant and equipment capacity.As a result, assume that the net fixed asset figure on the balance sheet will remain constant for both 20X4 and 20X5.Assuming that the ratios of assets (except fixed assets, net) to sales and accounts payable to sales in 20X3 remain the same in 20X4 and 20X5, calculate the total amount, i.e., one number, of external financing required during the 2 year period from 20X4 through 20X5, using the percentage of sales method.

Fillmore Co.Balance Sheet (December 31, 20X3)

($ millions)

Definitions:

Readability

Readability measures how easy it is for a reader to understand and comprehend written text, influenced by factors like sentence structure, choice of words, and layout.

Comprehension

The ability to understand and grasp the meaning of something, such as reading material or spoken language.

White Space

The unmarked portions of a page or screen, used in design and layout to create visual clarity and improve readability.

Typefaces

The designs of text characters in various styles and sizes, including serif, sans-serif, and script, used to enhance the readability and aesthetic of printed or digital text.

Q21: Wall Street recognizes and rewards firms that

Q21: Nukin' Gnats Pest Control wants to offer

Q26: A public cloud is a proprietary network

Q30: Compare the difference between compound interest and

Q40: Which of the following (if any) is

Q44: If an American Water Company bond has

Q52: A portfolio is efficient if .<br>A)for a

Q68: According to the shareholder wealth maximization goal,

Q87: A zero coupon bond is a bond

Q105: Which of the following is NOT one