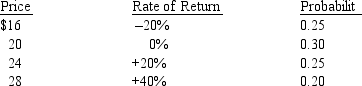

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the standard deviation of possible rates of return on Phoenix stock (to the nearest tenth of a percent) .

Definitions:

Q3: What is the present value of

Q11: The constant growth dividend valuation model does

Q14: A change in the market price of

Q25: Original issue deep discount bonds have decreased

Q75: A zero coupon bond with a $1,000

Q75: Parker Chemicals purchased a hexene extractor 10

Q79: Consider a capital expenditure project that has

Q80: Which of the following is not an

Q81: The stock of Melody Music City is

Q89: An investment project requires a net investment