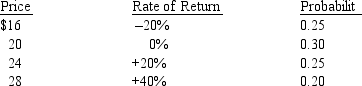

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the standard deviation of possible rates of return on Phoenix stock (to the nearest tenth of a percent) .

Definitions:

Phobia

An extreme or irrational fear or aversion to specific objects, scenarios, or situations, significantly impacting a person's life.

Unconditioned Stimulus

A stimulus that naturally and automatically triggers a response without any prior learning.

Conditioned Stimulus

A stimulus that was originally neutral but, upon being paired with an unconditioned stimulus, prompts a conditioned reaction.

Obsessive-Compulsive Disorder

A mental disorder characterized by repetitive, unwanted thoughts (obsessions) and repetitive behaviors (compulsions) that the individual feels compelled to perform.

Q16: In considering financial planning, the type of

Q20: Casa Chica is considering replacing a piece

Q57: Compute the risk premium for the stock

Q60: In analyzing the value of the firm

Q62: Financial leverage benefits shareholders when the<br>A)return on

Q71: Many IRA fund managers argue that investors

Q77: Determine the beta of a portfolio consisting

Q86: When evaluating international capital expenditure projects, the

Q89: Which of the following statements is/are correct

Q98: Your brother, who is 6 years old,