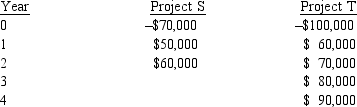

Dorati Inc.is considering two mutually exclusive projects.Dorati used a 15% required rate of return to evaluate capital expenditure projects.If the two projects have the costs and cash flows shown below, using a replacement chain determine the NPV for each.

Assume in two years Project S will still cost $70,000 and produce the same two years of cash flows.

Definitions:

Loading Dock

A designated area in a facility where goods are loaded onto or offloaded from vehicles or shipping containers.

Bailment

A legal relationship in which physical possession of personal property is transferred from one person to another, who subsequently holds the property for a certain purpose under an agreement.

Bailed Property

Personal property that has been transferred to another under a bailment agreement, where the receiver has a duty to return or handle the property as directed.

Compensation

Payment or benefit given, often to employees or in settlement of a claim, for services rendered, loss suffered, or injury incurred.

Q6: The cost of depreciation-generated funds is equal

Q11: The Modigliani-Miller theory that the value of

Q32: What is the present value of the

Q43: All of the following are reasons why

Q50: TCA Cable has fixed operating cost of

Q57: In considering the payback method,<br>A)It is a

Q62: Ten years ago J-Bar Company purchased a

Q92: Direct issuance costs are<br>A)higher for common stock

Q93: An investor, by investing in combinations of

Q96: The advantages of the payback approach include