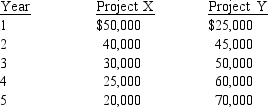

Quick Flick is considering two investments.Both require a net investment of $120,000 and have the following net cash flows:

Quick uses a combination of the net present value approach and the payback approach to evaluate investment alternatives.The firm uses a discount rate of 14 percent and requires that all projects have a payback period no longer than 3 years.Which investment or investments should Quick accept?

Definitions:

Short Run

A period of time in which at least one input, such as plant size, is fixed and cannot be changed by the firm, limiting its capacity to adjust output levels.

MC = P

A condition in economic theory where Marginal Cost (MC) equals Price (P), indicating optimal production levels where no additional units should be produced.

Profit

The financial gain obtained when the total revenues generated exceed the total costs incurred by a business.

Marginal Cost

The growth in total expenses incurred from the production of one more unit.

Q18: What would be the degree of financial

Q27: Nova earned $7.20 per share and maintains

Q40: Perfect capital markets imply the following:<br>A)there are

Q53: Given the following cash flows and

Q61: Red Lake Mines, Inc.is considering adoption of

Q76: The firm's receivables conversion period (measured in

Q102: If a preferred stock is callable, then

Q106: The net present value method assumes that

Q112: Lawton Company common stock currently sells for

Q116: Business risk is influenced by all the