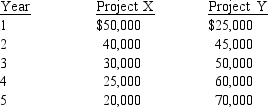

Quick Flick is considering two investments.Both require a net investment of $120,000 and have the following net cash flows:

Quick uses a combination of the net present value approach and the payback approach to evaluate investment alternatives.The firm uses a discount rate of 14 percent and requires that all projects have a payback period no longer than 3 years.Which investment or investments should Quick accept?

Definitions:

Average Method

An inventory costing method that calculates the cost of goods sold based on the average cost of all similar items in inventory.

Periodic Inventory System

An inventory system that records inventory purchases and sales periodically, updating the inventory balance at the end of an accounting period.

Average Cost

A method to determine the cost of goods sold and ending inventory by computing the weighted average of the costs of all goods available for sale.

Net Sales

The total revenue from sales minus returns, allowances, and discounts.

Q3: How can beta, a measure of systematic

Q5: How does the equivalent annual annuity approach

Q6: The cost of depreciation-generated funds is equal

Q17: is (are) used when evaluating mutually exclusive

Q27: The is the optimal working capital investment

Q29: What is the internal rate of return

Q53: The cost of internal equity is cheaper

Q71: Zero-Sum Enterprise expects to pay an annual

Q76: The the amount of debt in a

Q95: What is the current value of a