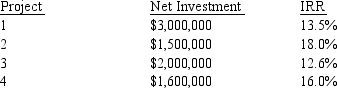

Far Out Tech (FOT) has a debt ratio of 0.3 and it considers this to be its optimal capital structure.FOT has no preferred stock.FOT has analyzed four capital projects for the coming year as follows:

FOT expects to earn $2.7 million after tax next year and pay out $700,000 in dividends.Dividends are expected to be $1.05 a share during the coming year and are expected to grow at a constant rate of 10 percent a year for the foreseeable future.The current market price of FOT stock is $22 and up to $2 million in new equity can be raised for a flotation cost of 10 percent.If more than $2 million is sold then the flotation cost will be 15 percent.Up to $2 million in debt can be sold at par with a coupon rate of 10 percent.Any debt over $2 million will carry a 12 percent coupon rate and be sold at par.If FOT has a marginal tax rate of 40 percent, in which projects should it invest?

Definitions:

Individual Assets

Specific items of property owned by an individual or entity, including tangible and intangible assets.

Straight-line Depreciation

A technique for distributing the expense of a physical asset across its lifespan in uniform yearly sums.

Plant Asset

An asset used in the operations of a business that is not intended for sale to customers and is referred to as property, plant, and equipment (PP&E) in accounting.

Adjusting Journal Entries

Journal entries made at the end of an accounting period to update certain accounts and ensure they accurately reflect the financial status of the business.

Q2: What are the procedures for repurchasing stock?

Q4: What is the signaling effect of dividend

Q17: Marcos Company annual sales are $730 million.Suppose

Q27: The managerial implications of capital structure theory

Q40: Sulzar's capital structure consists only of common

Q41: Drafts are:<br>A)payable on demand<br>B)legally paid on the

Q50: As the proportion of debt in the

Q58: A firm with a 40 percent marginal

Q72: What is the internal rate of return

Q97: An investor plans to invest 75 percent