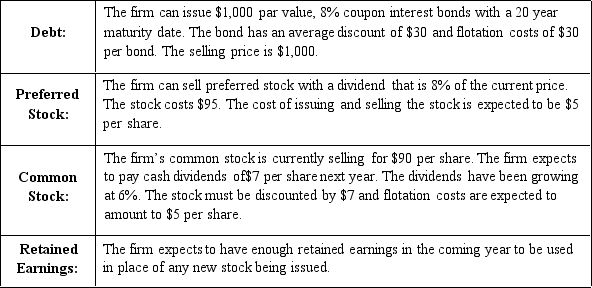

What is the cost of preferred stock for Foggy Futures Weather Forecasters? The firm is in the 40% tax bracket.The optimal capital structure is listed below:

Definitions:

Labour Efficiency Variance

Labour efficiency variance is the difference between the actual hours worked and the standard hours expected, multiplied by the standard labor rate, used to assess workforce performance.

Standard Labour Rate

A predetermined rate of pay established for work performed, used in budgeting and costing calculations.

Price Variance

A variance that is computed by taking the difference between the actual price and the standard price and multiplying the result by the actual quantity of the input.

Direct Material

Direct Material includes raw materials that are directly incorporated into a finished product and can be easily traced to the product itself.

Q24: relationship exists between a firm's liquid asset

Q27: Bluegrass Distilleries, Inc.refuses to extend credit to

Q36: The net cash flows for any year

Q60: The certainty equivalent factors used to adjust

Q62: Which of the following investment decision rules

Q63: Technico has determined that its optimal capital

Q71: Working capital policy involves day-to-day decisions that

Q80: A weakness of the payback period is

Q89: Which of the following are (is) generally

Q96: Ripstart is replacing an old, fully depreciated