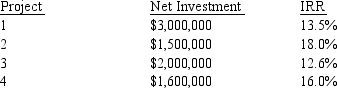

Far Out Tech (FOT) has a debt ratio of 0.3 and it considers this to be its optimal capital structure.FOT has no preferred stock.FOT has analyzed four capital projects for the coming year as follows:

FOT expects to earn $2.7 million after tax next year and pay out $700,000 in dividends.Dividends are expected to be $1.05 a share during the coming year and are expected to grow at a constant rate of 10 percent a year for the foreseeable future.The current market price of FOT stock is $22 and up to $2 million in new equity can be raised for a flotation cost of 10 percent.If more than $2 million is sold then the flotation cost will be 15 percent.Up to $2 million in debt can be sold at par with a coupon rate of 10 percent.Any debt over $2 million will carry a 12 percent coupon rate and be sold at par.If FOT has a marginal tax rate of 40 percent, in which projects should it invest?

Definitions:

Cereal Brands

Companies that manufacture and market different types of breakfast cereal.

Product Differentiation

The process of distinguishing a product or service from others in the market to make it more appealing to a specific target market.

Pure Monopoly

A market structure where a single supplier provides a unique product or service, facing no competition due to high barriers to entry.

State Utility Commission

A governmental body responsible for regulating the rates and services of utilities within a specific state.

Q6: Users of the CAPM should be aware

Q10: A digital assembly system that costs $160,000

Q14: The major components that determine the risk

Q18: Project C has been classified into risk

Q21: The dollar amount of interest charges is:<br>A)always

Q27: Two companies, Jefferson and Jackson, are virtually

Q68: All of the following are alternative dividend

Q75: Under a conservative approach to working capital

Q76: ZPS Models is considering a project that

Q90: Peterson Company expects earnings per share and