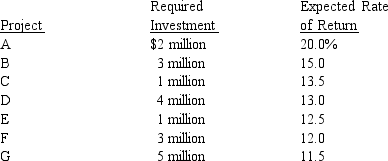

Whipple Industries, Inc.is in the process of determining its optimal capital budget for next year.The following investment projects are under consideration:

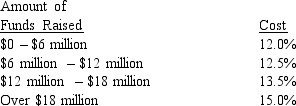

The firm's marginal cost of capital schedule is as follows:

Determine Whipple's optimal capital budget (in dollars) for the coming year.

Definitions:

Bonds

Financial instruments representing a loan made by an investor to a borrower, often corporate or governmental, that pays periodic interest and the principal at maturity.

Face Value

The amount the corporation must repay to the bondholder at the maturity date.

Interest

The cost of using money for a period of time.

Convertible Bonds

These are corporate bonds that holders can convert into a predetermined number of shares of the issuing company's stock, combining features of both debt and equity.

Q6: A stock dividend will not affect which

Q22: Capital Foods purchased an oven 5 years

Q37: Real options in capital budgeting can be

Q63: Technico has determined that its optimal capital

Q63: The effect of a change in a

Q65: List the various rights of common stockholders.

Q65: Smart Bumpkins wants to increase production

Q69: The management of Graphicopy is trying to

Q75: Under a conservative approach to working capital

Q86: Find beta and determine the required