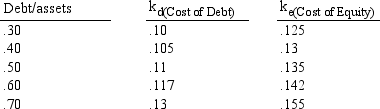

Feldspar Inc.is considering the capital structure for a new division.Management has been given the following cost information:

Based on this information, what capital structure (debt/asset ratio) should management accept? Assume the marginal tax rate is 40%.

Definitions:

Interest Paid

The amount paid by a borrower to a lender for the privilege of using borrowed money, typically expressed as an annual percentage of the loan outstanding.

Bond Discount

The gap between the nominal value of a bond and the price it fetches on the market when it is sold for an amount lower than its nominal value.

Straight-Line Amortization

A method of systematically reducing the cost value of an intangible asset over its useful life by charging equal expense amounts to each accounting period.

Effective-Interest Method

A method of calculating the interest expense on a bond or loan by applying the constant interest rate to the outstanding balance of the debt for each period.

Q2: When managers knowingly bias estimates of cash

Q6: The fastest method for moving funds between

Q15: Onyx expects to have an EBIT of

Q29: The effect of a change in a

Q34: All of the following are methods used

Q41: Decode Genetics purchased lab equipment for $600,000

Q45: Centex, a producer of telephone systems for

Q54: The management of Jasper Equipment Company is

Q64: What is the reason companies utilize the

Q65: In considering factoring accounts receivable, which of