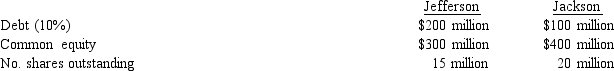

Two companies, Jefferson and Jackson, are virtually identical in all aspects of their operations except that the two companies differ in their capital structures, as shown below:

Both companies have $500 million in total assets and both have a 40% marginal tax rate.What is the EPS for Jackson at an EBIT level of $50 million?

Definitions:

Cost Of Goods Purchased

The total expense incurred to buy goods over a period, including transportation and handling, not yet necessarily sold.

Net Purchases

Net purchases refer to the total cost of purchases after adjusting for returns, allowances, and discounts over a specific period.

Cost Of Goods Available For Sale

The total cost of inventory available to be sold during a given period, including both beginning inventory and purchases made.

Purchase Returns

Goods returned by the buyer to the seller, usually because they are defective or not as per the order placed.

Q10: Last year, Quality's earnings per share were

Q21: The cost of capital is<br>A)the rate of

Q34: Tool Mart sells 1,400 electronic water pumps

Q37: The use of fixed cost sources of

Q44: are needed for sensitivity analysis and have

Q48: All of the following portfolio criteria used

Q53: When factoring accounts receivables, the factor is

Q63: Some companies use debt or preferred stock

Q77: Wrenn Corp.has 5.6 million shares outstanding, interest

Q92: Using the profitability index, which of