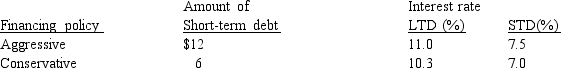

Laserscope Inc.is trying to determine the best combination of short-term and long-term debt to employ in financing its assets.Laserscope will have $16 million in current assets and $20 million in fixed assets next year and expects operating income (EBIT) to be $4.1 million.The company's tax rate is 40% and its debt ratio is 50%.The firm's debt will be financed by one of the following policies:

What is the return on shareholder's equity under each policy?

Definitions:

Scientific Understanding

The comprehension and application of scientific methods and principles to explain phenomena and solve problems.

Goals

End results or objectives that an individual, group, or organization is aiming to achieve.

World Population

The total number of living humans on Earth at a given time.

Broad Approach

A wide-ranging or comprehensive method or perspective that encompasses a variety of factors, elements, or principles.

Q6: When considering bond refunding, all of the

Q10: The credit policy variables that a firm

Q17: The contribution margin per unit is the

Q31: Firms can raise capital in two ways.Why

Q31: The Ogden Company has warrants outstanding that

Q36: The use of fixed-cost financing sources is

Q53: The measures the promptness with which customers

Q59: What is Bodacious Bodywear's weighted average cost

Q69: Capacity, which is one of the traditional

Q70: Whipple Industries is considering the acquisition of