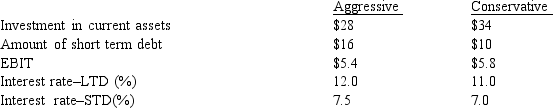

Cisco Systems wishes to analyze the joint impact of its working capital investment and financing policies on shareholder return.The company has $24 million in fixed assets.Cisco wishes to maintain a debt ratio of 40%.The company's tax rate is also 40%.The following information was developed for the two policies under consideration (dollars in millions) :

For the aggressive approach, Cisco's ROE is and for the conservative approach the ROE is .

Definitions:

Stock Split

A corporate action that increases the number of a company's shares by issuing more shares to current shareholders, thus reducing the price per share.

Common Stock Dividend

A portion of a company's earnings distributed to shareholders of its common stock, typically in the form of cash or additional shares.

Common Shares Outstanding

The total number of shares of a company that are owned by shareholders, excluding shares owned by the company itself.

Treasury Stock

Shares previously counted among a company's outstanding shares but were later bought back by the business.

Q1: The costs of a lockbox collection system

Q8: A short hedge requires the a futures

Q23: What are two hedging techniques that a

Q39: Which of the following trade policies will

Q39: Currency and commodity price volatility is a

Q42: What is an interest rate swap? Describe

Q42: In considering purchasing power parity, the relationship

Q74: In what way does management's willingness to

Q91: In the theoretical world of Miller and

Q102: If a preferred stock is callable, then