Free Trade Game

Free trade occurs when goods and services between countries flow unhindered by government-imposed restrictions such as tariffs, quotas, and antidumping laws that are often designed to protect domestic industries. Although it is well known that free trade creates winners and losers, a broad consensus exists among most economists that free trade has a large and unambiguous net gain for society as a whole. For example, Robert Whaples (2006) finds in a survey of economists that "87.5% agree that the U.S. should eliminate remaining tariffs and other barriers to trade" and that "90.1% disagree with the suggestion that the U.S. should restrict employers from outsourcing work to foreign countries." Despite this consensus, it is not at all clear that countries will actually adopt policies promoting free trade.

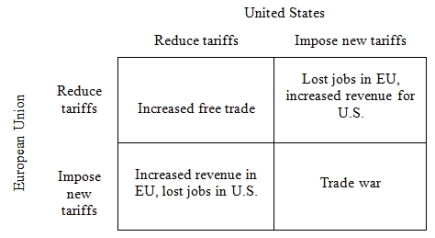

Consider the following strategic situation in which the United States and the European Union (EU) are engaged in trade negotiations. Both countries must decide whether to reduce their tariffs or impose new tariffs. The best outcome for both countries is for them to impose new tariffs and for the other side to reduce tariffs; they could then export more easily to the other country and they would obtain increased revenue from the new tariffs. The worst outcome for both countries is for them to reduce tariffs and for the other country to increase tariffs; they would lose jobs as a result of reduced exports and the other country would benefit from their lower tariffs. Of the remaining two outcomes, both countries prefer the outcome in which they reduce tariffs to the one in which they both impose new tariffs. If both countries reduce their tariffs, then each country can benefit from increased free trade. If both countries impose new tariffs, there is a trade war in which each country sees a decline in trade and a loss of jobs. Based on this story, the preference ordering for the EU over the four possible outcomes is:

• Impose; Reduce > ; Reduce > Impose; Impose > Reduce; Impose.

And the preference ordering for the United States is:

• Reduce; Impose > Reduce; Reduce > Impose; Impose > Impose; Reduce,

where the EU's action is given first, the United States' action is given second, and ">" means "is strictly preferred to."

Using the ordinal preferences (4, 3, 2, 1) to capture these preference orderings, fill in the empty payoff matrix. Based on the preference orderings in the Free Trade Game.

Figure 1: Free Trade Game

-Using the payoffs from the Free Trade Game, what is the present value of reducing tariffs?

Definitions:

Public Choice Theory

A theory in economics and political science that studies how public sector actions and policies are influenced by the self-interest of individuals, especially politicians and bureaucrats, as opposed to the public good.

Keynesian Economics

An economic theory stating that government intervention is necessary to help economies emerge from recession, through policies that stimulate demand, control inflation, and adjust interest rates.

Paradox of Voting

The concept that for a rational, self-interested voter, the costs of voting will normally exceed the expected benefits, given the low probability that one vote will influence the outcome.

Majority Voting

A voting system in which decisions are made based on the majority of votes received, often used in elections and organizational decision-making processes.

Q2: "Democracies are more likely to survive if

Q4: The last step of the 6D MVMS

Q8: All of the following are SaaS Services

Q10: The existence of the mechanical effect of

Q30: What is the specific identification cost flow

Q33: The noninterventionist policy of which Soviet leader

Q33: Is this argument valid or invalid?<br>A) valid<br>B)

Q39: Which of the following statements is consistent

Q40: Look at Table 11.17 at the end

Q47: Let's say we want to apply the