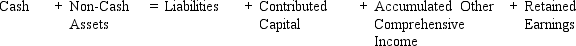

The analytical framework used to evaluate transactions is reproduced below:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

1.Staples recorded cash sales of $25,000.The merchandise had cost $19,000 to manufacture.

2.Staples purchased $8,500 of raw material inventory on account.

3.The company paid $2,500 for property insurance for the next 12 months.

4.Staples paid its employees $5,000 for the month.

5.The company purchased $1,000 of supplies on account.

6.Staples issued $25,000 of long-term debt.

7.The company used $10,000 of excess cash to purchase marketable securities.

8.Staples purchased a machine for $16,000 using $8,000 cash with the balance on account.

9.Staples paid $2,500 for interest expense on the long-term debt.

10.At the end of the year the marketable securities that Staples purchased in transaction 7 were now worth $14,500.

11.Depreciation for the period was $1,500.

12.Staples examined the equipment and determined that its fair value was $10,000.

Definitions:

Dignity and Respect

Refers to the moral principle of treating individuals as valuable and worthy of honor, as well as valuing their rights, choices, and freedoms without discrimination.

MAOI (Monoamine Oxidase Inhibitor)

A type of antidepressant medication that works by inhibiting the enzyme responsible for breaking down neurotransmitters in the brain.

Patients' Bill of Rights

A list of guarantees for those receiving medical care, ensuring fair treatment, privacy, and information about one’s conditions and treatments.

Persuasive Recommendations

Suggestions or advice designed to convince or influence someone's decision or viewpoint favorably.

Q3: When net income is low relative to

Q4: Much of what is known about community

Q11: Refer to the information for Net Devices

Q14: In general,the shorter the number of days

Q21: _ is defined by the FBI as

Q35: Dr.Olweus's program to prevent bullying is used

Q40: Police _ schools involve youth in police

Q41: A manner of dress that uses an

Q63: On January 1,2012,Deputron Company's beginning inventory was

Q66: On December 31,2009,Loran Corporation reported a deferred