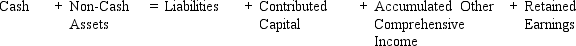

The analytical framework used to evaluate transactions is reproduced below:

Using this analytical framework indicate the effect of each of the following transactions for Staples Corporation:

1.Staples recorded cash sales of $25,000.The merchandise had cost $19,000 to manufacture.

2.Staples purchased $8,500 of raw material inventory on account.

3.The company paid $2,500 for property insurance for the next 12 months.

4.Staples paid its employees $5,000 for the month.

5.The company purchased $1,000 of supplies on account.

6.Staples issued $25,000 of long-term debt.

7.The company used $10,000 of excess cash to purchase marketable securities.

8.Staples purchased a machine for $16,000 using $8,000 cash with the balance on account.

9.Staples paid $2,500 for interest expense on the long-term debt.

10.At the end of the year the marketable securities that Staples purchased in transaction 7 were now worth $14,500.

11.Depreciation for the period was $1,500.

12.Staples examined the equipment and determined that its fair value was $10,000.

Definitions:

Extraversion

A characteristic defining someone as being energetic, extroverted, and fond of social interactions.

Openness

Openness is a personality dimension that involves the appreciation for art, emotion, adventure, unusual ideas, imagination, curiosity, and variety of experience.

Learning Approach

The theoretical view that focuses on how behavior changes as a function of rewards and punishments; also called behaviorism.

Rewards And Punishment

A concept in behaviorism where positive outcomes are used to reinforce desired behavior, and negative outcomes are used to deter undesirable behavior.

Q12: Coffee Corp.purchased 45% of the outstanding shares

Q15: Which of the following companies would you

Q36: The receipt of cash when employees exercise

Q50: For the following types of companies,discuss whether

Q55: What is the effect of the declaration

Q58: Jihad refers to what?<br>A)Hate the Americans<br>B)Fight until

Q59: Net income is equal to:<br>A) Assets minus

Q61: _ is the nation's largest firearm safety

Q65: An example of an intangible asset is<br>A)

Q94: Which of the following would not appear