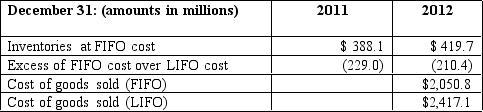

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Definitions:

Original Constitution

Refers to the initial version of the United States Constitution before any amendments were added, outlining the framework for the national government and its relationship with states and citizens.

Electoral Ballots

The paper or electronic devices used in elections for voters to select their choices among candidates and issues, playing a crucial role in the democratic process.

Presidential Power

Refers to the legal and political authority granted to the President of the United States by the Constitution, including executive, legislative, and judicial functions.

Impeach

To accuse a public official, particularly a governmental officeholder, of misconduct, leading to a trial to determine whether they can remain in office.

Q4: _ concerns a firm's ability to make

Q21: When deriving the equity value of a

Q23: Foxmoor Company's merchandise inventory and other

Q40: Financial statement forecasts rely on additivity within

Q51: Which of the following items is consistent

Q53: Discuss the difference between transferring receivables with

Q67: All of the following are problems associated

Q78: Firms that capitalize routine maintenance and repair

Q82: Differences between income before taxes and taxable

Q91: Magnum Construction contracted to construct a