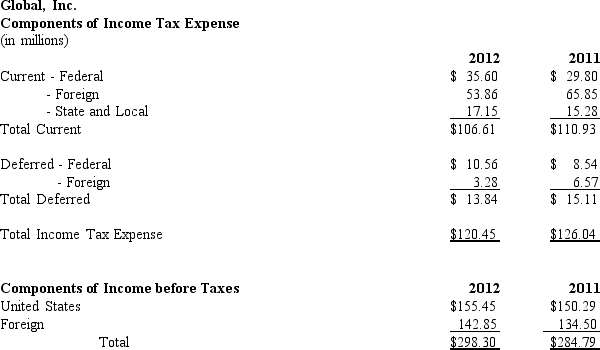

Global,Inc.provides consulting services throughout the world.The company pays taxes to the nation where revenues are earned.Information about the company's taxes are presented below:

Required:

a.Using the information provided for Global,prepare the company's journal entry to record income taxes for 2012 and 2011.

b.Using the information provided for Global,determine the company's effective tax rate for 2012 and 2011.

Definitions:

Approve

To officially agree to or sanction something, often through a formal process.

Merger

The combination of two or more companies into a single entity, often with the goal of expanding market share or reducing competition.

Merger Plan

is a documented strategy that outlines the process and goals of merging two or more companies into one entity, including the financial, operational, and legal implications.

Subsidiary's Shareholders

Subsidiary's Shareholders are individuals or entities that own shares or stock in a subsidiary company, which is a company controlled by another business, known as the parent company.

Q24: The major difference between accounting for pensions

Q40: Penny Corp.manufactures telecommunication equipment and has

Q46: Securities that are purchased in order to

Q47: Regarding the equity buyout,compute the weighted average

Q52: When a firm sells a trading security,it

Q52: Techtronics is a leader in manufacturing

Q53: Carlson Company began constructing a building for

Q53: The required earnings of the firm equals

Q60: In developing forecasts of expenses the analyst

Q64: Over sufficiently long periods,_ equals free cash