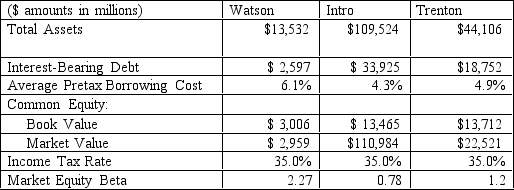

Watson manufactures and sells appliances.Intro develops and manufactures computer technology.Trenton operates general merchandise retail stores.Selected data for these companies appear in the following table (dollar amounts in millions).For each firm,assume that the market value of the debt equals its book value.

Required: a.Assume that the intermediate-term yields on U.S.Treasury securities

are roughly 3.5 percent.Assume that the market risk premium is 5.0 percent.

Compute the cost of equity capital for each of the three companies.

b.Compute the weighted average cost of capital for each of the three companies.

c.Compute the unlevered market (asset)beta for each of the three companies.

Definitions:

Elicit Salivation

Stimulating the production of saliva through various means, commonly associated with conditioned responses in classical conditioning experiments.

Pairing

The process of associating two events or stimuli together, often used in conditioning wherein a neutral stimulus becomes associated with a meaningful one.

Generalization

The process of applying the outcomes of specific instances to broader situations or populations, often seen in learning and reasoning.

Conditioned Response

A learned response to a previously neutral stimulus that has become associated with an unconditioned stimulus through conditioning.

Q7: U.S.GAAP requires firms to expense immediately all

Q11: a.Compute the price-earnings ratio under the following

Q17: Why are dividends value-relevant to common equity

Q19: Which of the following statements is TRUE

Q30: Steady-state growth in free cash flows could

Q34: Under IFRS,when an asset is revalued upwards,subsequent

Q45: Which of the following accounts would not

Q60: Over the life of a firm,the capital

Q67: United owns Estada,a European based subsidiary

Q74: Which of the following statements best describes