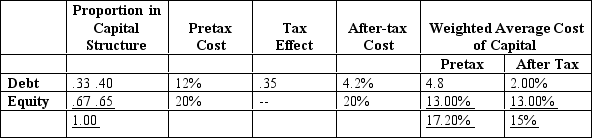

Suppose a firm faces the following costs of capital:

Assume that this firm expects to generate $95 million of pretax-free cash flows.

Required:

(1)What would be the after-tax free cash flows one year from today?

(2)Assuming a one-year horizon,what is the appropriate valuation to be used by the analyst?

Definitions:

Patriot Cause

The movement and ideological drive toward independence from British rule among the American colonies, particularly during the late 18th century.

Thomas Paine

A political activist and writer whose works, including "Common Sense" and "The American Crisis," were influential in the American Revolution and the promotion of democratic ideals.

Benedict Arnold

An American military officer who served during the Revolutionary War before defecting to the British side in 1780, becoming synonymous with betrayal.

American Ally

A country that is in a mutual agreement with the United States to support each other, especially in terms of defense and international policy.

Q5: Under which of the following scenarios would

Q18: The _ is the date a firm

Q21: If a firm competes in a capital-intensive

Q22: Nonsystematic risk factors would include all of

Q31: A(n)_ lease arrangement is one in which

Q41: Based on the information concerning Record Corp.what

Q45: As a firm progresses through the growth

Q45: Which of the following is(are)a difficulty in

Q47: Regarding the equity buyout,compute the weighted average

Q78: Presented below is pension information related to