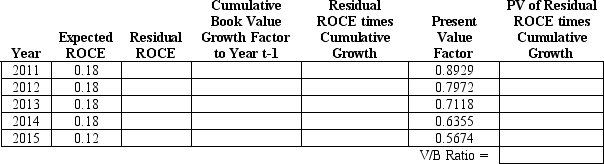

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 12 percent.Assume that the analyst forecasts that the firm will earn ROCE of 18 percent until year 2015,when the firm will start earning ROCE equal to 12 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Common Form

A standardized or widely used version of a document, agreement, or legal form.

Value

The importance, worth, or usefulness of something to individuals or society.

Pattern Recognition

The process of identifying patterns in data, enabling recognition, categorization, and prediction.

Entrepreneurial Opportunity

A favorable set of circumstances that creates a need for a new product, service, or business.

Q3: The authors set forth a seven-step forecasting

Q5: Suppose that savers become much more willing

Q6: It may be difficult to forecast sales

Q17: Firms recognize an impairment loss when the

Q26: Determine the weight on equity capital that

Q26: Clean surplus accounting means that _ include

Q68: On January 1,2012,Brock Company purchased $200,000,8% bonds

Q75: When the price of a coupon bond

Q76: One sign that a company may be

Q117: According to a Federal Reserve study,electronic payments