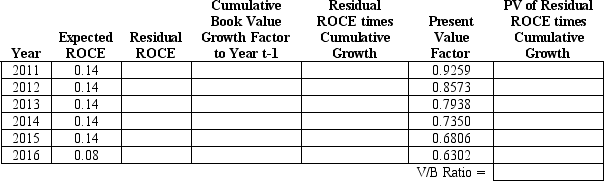

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent.Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2016,when the firm will start earning ROCE equal to 8 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Marketing Mix

The combination of factors that can be controlled by a company to influence consumers to purchase its products, traditionally identified as product, price, place, and promotion.

Stable

Firm, steady, or not prone to sudden changes or deterioration, often used to describe economic or environmental conditions.

True Fan

A dedicated supporter or enthusiast of a particular product, brand, musician, etc., whose loyalty is strong and enduring.

Apple Products

Consumer electronics and software products developed by Apple Inc., such as iPhones, iPads, and Mac computers.

Q6: In some industries,competitive dynamics eventually drive long-run

Q7: Normally,valuation methods are designed to produce reliable

Q20: The process of allocating the historical cost

Q23: Under the value-to-book model new projects will

Q37: Regarding the equity buyout,compute the unlevered market

Q51: If you buy a bond issued by

Q54: Following the downgrade of U.S.debt by Standard

Q62: _ is the amount by which expected

Q94: How can a bond have a negative

Q108: In the bond market,the buyer is considered