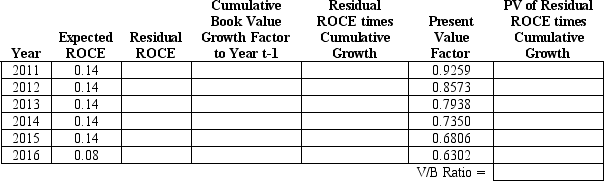

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent.Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2016,when the firm will start earning ROCE equal to 8 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Description

A detailed explanation or account of something that provides more information about it.

Summary

A brief statement or account that presents the main points or essence of a document or article.

Process Description

A detailed explanation of how something works or how to perform a set of actions to achieve a specific outcome.

Glossary Terms

A list of specialized or technical words with their definitions, often found at the end of a book or document.

Q5: Steady-state growth in _ could be driven

Q16: All of the following are considered by

Q21: Residual income is<br>A) adjusted net income the

Q25: The following problem requires some of

Q28: Increased liquidity in recent decades has reduced

Q34: If Parnell Industries is certain that it

Q38: U.S.GAAP stipulates that firms should _ expenditures

Q52: Financial statements for Hawk Company are presented

Q58: A firm in transition from the high

Q92: Why may investors buy a Treasury bill