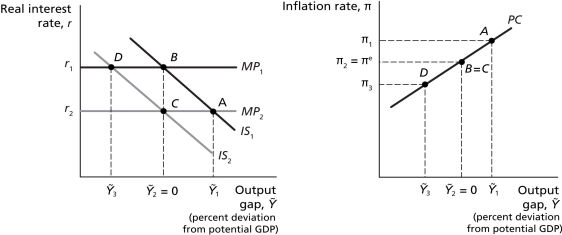

Figure 12.4

Scenario: The above figures represent the economy of Mondolvia, where points A, B, C, and D in the first figure reflect the corresponding points in the second figure. The economy of Mondolvia is initially at equilibrium with real GDP equal to potential GDP. In April 2012, Mondolvia reached the peak of a rapid housing bubble that dramatically increased consumer wealth. The central bank of Mondolvia recognized this housing bubble peak existed in June, 2012 and implemented corrective policy in August 2012. The corrective policy actually changed output in the economy 12 months after it was implemented. In the meantime, the housing bubble burst in December 2012, returning the economy back to its initial, pre-bubble equilibrium level.

-Refer to Figure 12.4.The increase in consumer wealth resulting from the housing bubble is best represented by a movement from

Definitions:

Expected Return

The anticipated profit or loss from an investment, taking into account the potential outcomes and their probabilities.

SMB Beta

A measure used in the evaluation of stocks, indicating a stock's sensitivity to movements in the small minus big (SMB) factor, part of the Fama-French three-factor model.

HML Beta

A measure of sensitivity to the HML (High Minus Low) factor, part of the Fama-French three-factor model, indicating how much a stock's return is affected by the value premium.

Risk Premium

The additional return expected on an investment for taking on higher risk compared to a risk-free asset.

Q5: Assume that seigniorage and the government's primary

Q7: <b>Refer to Figure 14.3.</b>Suppose the economy is

Q10: C = $5 million + 0.9(1 -

Q13: Diminishing marginal returns do not exist for

Q14: When considering how to respond in a

Q16: Each suicide is idiosyncratic,and there are no

Q21: What is a cyclically adjusted budget deficit

Q21: <b>Refer to Figure 9.1.</b>Assume the economy is

Q42: <b>Refer to Figure 6.4.</b>If the actual wage

Q45: In countries with very restrictive labour laws,many