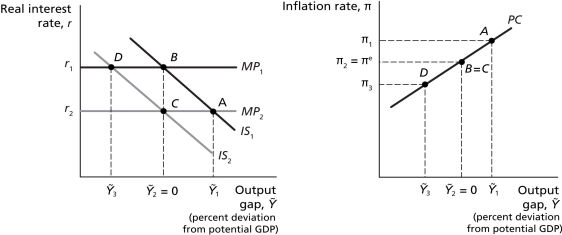

Figure 12.4

Scenario: The above figures represent the economy of Mondolvia, where points A, B, C, and D in the first figure reflect the corresponding points in the second figure. The economy of Mondolvia is initially at equilibrium with real GDP equal to potential GDP. In April 2012, Mondolvia reached the peak of a rapid housing bubble that dramatically increased consumer wealth. The central bank of Mondolvia recognized this housing bubble peak existed in June, 2012 and implemented corrective policy in August 2012. The corrective policy actually changed output in the economy 12 months after it was implemented. In the meantime, the housing bubble burst in December 2012, returning the economy back to its initial, pre-bubble equilibrium level.

-Refer to Figure 12.4.As a result of the monetary policy taking effect after the housing bubble had already burst,real GDP will be ________ potential GDP and the rate of inflation will be ________ the rate of inflation when the economy was initially in equilibrium.

Definitions:

Marketing Communication

The process of using various channels and messages to communicate with a market, including advertising, sales promotion, and public relations.

Direct Link

A straight, uninterrupted connection or communication channel between two entities, typically referring to network links or business relationships.

Consumer's Purchase

The act of a consumer buying products or services for personal use.

Public Relations

The practice of managing and disseminating information from an organization to the public to influence their perception.

Q2: In Canada,<br>A) exchange rate stability is sacrificed

Q3: An increase in the inflation rate results

Q12: In initial diagnosis,crisis case handling always attempts

Q37: The president of the hypothetical country of

Q40: From 1950 to 2009,the average length of

Q42: Since 1981,which of the following federal expenditures,measured

Q59: Suppose that the production function is Y

Q61: If the economy experiences an unanticipated demand

Q62: Explain why some shifts to the aggregate

Q67: Using AK growth models and assuming that