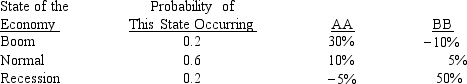

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational,risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

Definitions:

Security Returns

The gains or losses from investing in a financial security, calculated based on the change in investment value and any income from the investment, like dividends.

Systematic Factors

Factors that affect the entire market or a large segment of the market, such as economic, political, or social changes.

Expected Inflation

The anticipated rate at which the general level of prices for goods and services will rise over a period, eroding purchasing power.

Lintner

Lintner refers to John Lintner, an economist known for his work on the dividend policy of firms and contributions to the capital asset pricing model (CAPM).

Q12: Joel Foster is the portfolio manager

Q18: Bonner Corp.'s sales last year were $415,000,and

Q26: Kessen Inc.'s bonds mature in 7 years,have

Q43: Sentry Corp.bonds have an annual coupon payment

Q51: A portfolio's risk is measured by the

Q52: Kelly Enterprises' stock currently sells for $35.25

Q60: Which of the following statements is CORRECT?<br>A)

Q117: Time lines can be constructed for annuities

Q131: A stock's beta is more relevant as

Q166: Suppose you deposited $5,000 in a bank