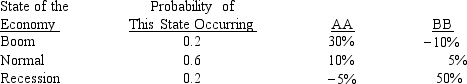

The distributions of rates of return for Companies AA and BB are given below:

We can conclude from the above information that any rational,risk-averse investor would be better off adding Security AA to a well-diversified portfolio over Security BB.

Definitions:

Dividend Yield

A financial ratio that shows how much a company pays out in dividends each year relative to its share price.

Market Price

The current amount at which an asset or service can be bought or sold.

Dividends Per Share

Measures the extent to which earnings are being distributed to common shareholders.

Liquidity

The simplicity of turning an asset into cash without impacting its market value.

Q4: Billy Thornton borrowed $20,000 at a rate

Q6: When considering two mutually exclusive projects,the firm

Q12: Joel Foster is the portfolio manager

Q30: Last year Central Chemicals had sales of

Q38: Charlie and Lucinda each have $50,000 invested

Q67: If a firm finances with only debt

Q82: What's the future value of $1,500 after

Q99: Sherrie Hymes holds a $200,000 portfolio consisting

Q105: Your bank offers to lend you $100,000

Q127: You plan to analyze the value of