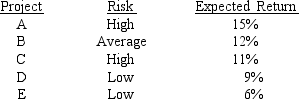

Laramie Labs uses a risk-adjustment when evaluating projects of different risk.Its overall (composite) WACC is 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Laramie evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Definitions:

Critical Thinkers

Individuals who engage in the process of logically analyzing and evaluating an issue or idea to reach a well-justified conclusion.

Flaws in Arguments

Logical fallacies or errors in reasoning that undermine the validity of an argument.

Critical Thinkers

Individuals who actively engage in analysis, synthesis, evaluation, and reconstruction of information or beliefs, in a structured manner.

Opinions

Personal beliefs or judgments that are not necessarily based on fact or knowledge, but on feelings, tastes, or preferences.

Q17: Porter Plumbing's stock had a required return

Q20: Which of the following statements is CORRECT?<br>A)

Q24: The cost of capital may be different

Q28: The AFN equation assumes that the ratios

Q34: In 1985,a given Japanese imported automobile sold

Q50: If investors' aversion to risk rose,causing the

Q54: Which of the following statements is CORRECT?<br>A)

Q55: Daylight Solutions is considering a recapitalization that

Q107: Which of the following statements is CORRECT?

Q144: If the price of money (e.g.,interest rates