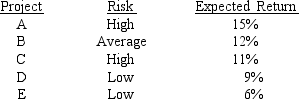

Laramie Labs uses a risk-adjustment when evaluating projects of different risk.Its overall (composite) WACC is 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Laramie evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Definitions:

Keynes

An economist who advocated for government intervention in markets to mitigate the adverse effects of economic recessions and depressions through fiscal and monetary policies.

Government Spending

Expenditures made by the public sector on goods and services such as healthcare, education, and defense, which can impact the country's economy.

Federal Budget Deficit

The shortfall where the federal government's expenditures exceed its revenues in a given fiscal year.

Recessions

Recessions are periods of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

Q3: If a dollar will buy fewer units

Q14: When a firm refunds a debt issue,the

Q24: The cost of capital may be different

Q27: As the assistant to the CFO of

Q35: Which of the following statements is CORRECT?<br>A)

Q49: Which of the following statements is correct?<br>A)

Q57: Ellmann Systems is considering a project

Q59: Which of the following statements is CORRECT?<br>A)

Q61: Kiley Electronics is considering a project

Q146: Which of the following statements is CORRECT?<br>A)